Table of Contents

Introducing EFT Auto Cancellation on Repeated Declines

EFT Auto Cancel is a powerful tool that streamlines the management of recurring payments, offering a host of advantages to enhance your business operations.

At its core, this feature ensures consistent and timely revenue by automatically identifying and addressing accounts with repeated payment failures. This optimization of cash flow not only bolsters your financial stability but also provides real-time insights into your financial health, empowering you to make well-informed decisions.

Here's how it works:

- Choose the number of consecutive declines before the system sets a cancellation date.

- You’ll receive an email notification when an account is scheduled for cancellation (usually 10 days in advance, but adjustable).

- No action is needed unless you wish to prevent cancellation, which you can easily do by clearing the cancellation date from the account.

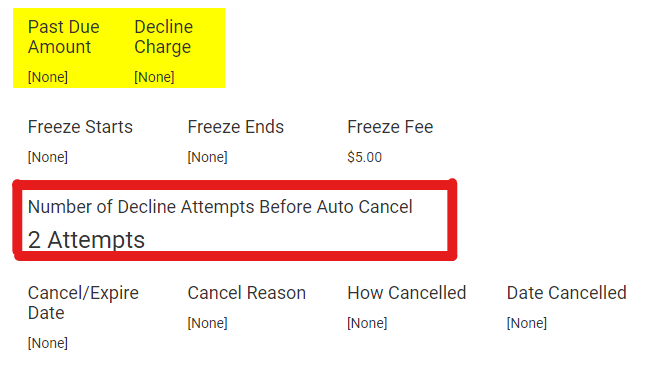

***You can find the ‘Number of Decline Attempts Before Auto Cancel’ in each customer’s account under Account Details > Membership Details tab.***

Benefits of EFT Auto Cancellation

Consistent Revenue Flow: EFT Auto Cancel ensures your revenue arrives consistently and punctually by automatically identifying and addressing accounts with repeated payment failures. This optimization of cash flow not only preserves your financial stability but also provides a real-time view of your financial health, enabling more informed decision-making.

Reduced Administrative Burden: Traditional methods of managing declined payments can be labor-intensive and error-prone. EFT Auto Cancel automates this process, freeing your staff to concentrate on strategic tasks like enhancing customer service and devising growth strategies.

Effective Customer Communication: The system initiates automated notifications to customers facing payment declines, granting them the opportunity to rectify the issue before their account faces cancellation. This proactive approach minimizes service disruption and fosters engagement, strengthening customer relations.

Accurate Financial Reporting: EFT Auto Cancel maintains the precision of your financial reports by promptly canceling non-paying accounts. This precise financial data empowers you to make data-driven decisions and plan confidently for the future.

Churn Reduction: EFT Auto Cancel minimizes the likelihood of customer churn due to payment issues, preserving your long-term revenue and customer base stability.

Customization: The system’s hallmark feature allows you to configure parameters, such as the number of consecutive declined payments required before initiating cancellation, aligning it with your unique business needs.

Enhanced Operational Efficiency: Automation eliminates the risk of human error and guarantees consistent policy adherence. This operational efficiency is particularly beneficial as your business scales and manages a larger customer base without overburdening your staff.

In summary, EFT Auto Cancel is a versatile tool that simplifies payment management, enhances cash flow, reduces churn, and offers customization to boost efficiency, making it a valuable addition to your business toolkit.

Summary of EFT Auto Cancellation

EFT Auto Cancel offers a range of valuable benefits for businesses managing recurring payments. One of the primary advantages is its ability to streamline payment management. By automating the process of identifying and handling non-paying accounts, it ensures that your revenue stream remains timely and consistent. This not only improves your cash flow but also provides you with a clearer financial picture.

Additionally, EFT Auto Cancel reduces the administrative burden on your team. Manually tracking and addressing declined payments can be time-consuming and prone to errors. With automation, you can reallocate your staff’s time and energy to more strategic tasks, such as improving customer service or developing growth strategies.

Effective customer communication is another key benefit. The system sends automated notifications to customers with declined payments, giving them an opportunity to address the issue before cancellation. This proactive approach can foster better customer relations and increase the likelihood of resolving payment issues without service interruption.

Furthermore, EFT Auto Cancel ensures that your financial reports accurately reflect the state of your business. By automatically canceling non-paying accounts, you have a more realistic view of your active customer base. This accuracy enables you to make informed financial decisions and plan for the future more effectively.

Moreover, the system can help reduce customer churn. Non-payment is a common reason for customers to leave a service. By automatically canceling non-paying accounts, you decrease the likelihood of customers churning due to payment issues. This, in turn, benefits your long-term revenue and customer base stability.

Customization is often a feature of EFT Auto Cancel. You can set parameters, such as the number of consecutive declined payments before cancellation, to align with your business’s specific needs. This flexibility ensures that the system adapts to your requirements.

Lastly, EFT Auto Cancel contributes to greater operational efficiency. Automation reduces the risk of human error and ensures that cancellations are consistent and in line with your policies. This efficiency is particularly valuable as your business scales and handles a larger customer base without significantly increasing your staff’s workload.

In summary, EFT Auto Cancel is a valuable tool for businesses seeking to optimize payment management, improve cash flow, and enhance customer relations. Its automation capabilities simplify processes, reduce administrative tasks, and provide a more accurate view of your financial health.”